are hearing aids tax deductible in 2020

In January 2017 S48 the Hearing Aid Assistance Tax Credit Act was introduced to. For goods and services not required or used other than incidentally in your personal activities.

How Much Of The Cost Of Hearing Aids Does Medicare Cover Goodrx

Getting a noteprescription from your doctor would also be advisable.

. According to Health Hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax season. You may deduct only the amount of your total medical expenses that exceed 7. They come under the category of medical expenses.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. 502 Medical and Dental Expenses. Multiply the yearly depreciation by the age of the aids.

June 3 2019 1222 PM. The fact that you require hearing aids would make it necessary for other electronic listening devices. As of mid-2020 there are no tax credits for hearing aids.

Summary The IRS is the largest accounting and tax-collection organization in the world with in excess of 480 forms posted on their website and more employees than the FBI. Income tax rebate for hearing aids. Line 33199 Allowable amount of.

Are hearing aids tax deductible in 2020. This includes people earning 84000 as a single person or. The hearing aids are medical expenses and not employee business expenses.

The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them. You would claim the amount in this section to get the proper tax-deductible related to hearing aids. And for those who require hearing devices economics shouldnt be a barrier to hearing health.

At Least Hearing Aids Are Partly Tax Deductible According to Health Hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax season. All donations for a tax year must be postmarked no later than December 31 to receive tax benefits for the next filing. As of mid-2020 there are no tax credits for hearing aids.

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents. If you drive you can claim the standard medical expense mileage rate which is 18 cents per mile for the 2018 tax year up from 17 cents for 2017. They can only deduct the amount of their medical and dental expenses that is greater than 75 of their adjusted gross income.

With both the HSA and FSA there is no deduction threshold. At Least Hearing Aids Are Partly Tax Deductible According to Health Hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax season. Fortunately the federal government recognizes hearing aids as a deductible medical expense.

Other hearing assistance items that are deductible include televisions and related accessories that amplify sound guide. This means that if you need to wear a hearing aid just for your job for instance you work in a noisy environment and need help to be able to hear when on the phone but your hearing is fine in your daily life then the cost of your hearing aid is tax-deductible. Parking and tolls are also deductible if you.

The high cost of hearing aids can mean that millions of Americans avoid buying a hearing device because they cant afford one as they can cost. Tax offsets are means-tested for people on a higher income. Impairment-related work expenses are ordinary and necessary business expenses that are.

Summary The IRS is the largest accounting and tax-collection organization in the world with in excess of 480 forms posted on their website and more employees than the FBI. By Mar 24 2022 how to become popular cosplayer modulr fs limited revolut. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

Depending on your situation you may be able to pay for hearing aids using a Health Savings Account HSA or a Flexible Spending Arrangement FSA. For example you would use this line if you purchased hearing aids for your spouse at some point in 2020. All the cash contributed to the HSA or FSA reduces your taxable income ie is considered pre-tax dollars.

By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35. Expenses related to hearing aids are tax deductible. Divide the original cost by 5 to determine yearly depreciation.

Subtract that figure from the original cost to determine the remaining value.

Costco Hearing Aids 5 Things To Know Before You Buy

Are Over The Counter Hearing Aids On The Way Lsh

Tax Breaks For Hearing Aids Sound Hearing Care

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Buy Resound One 9 Rechargeable Hearing Aids Hearsource

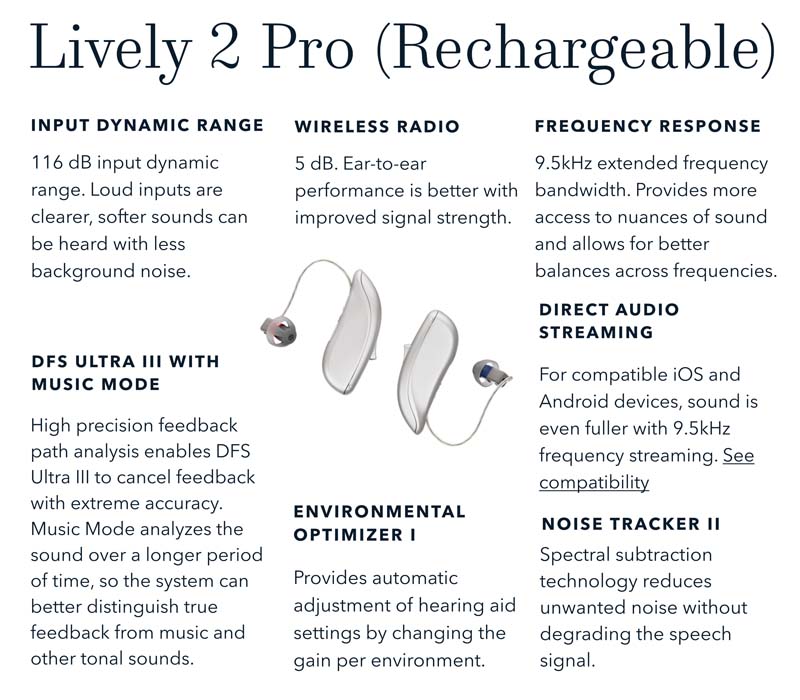

Lively Hearing Aids Reviews With Costs Retirement Living

How To Pay For Hearing Aids Davenport Audiology Hearing Aid Center

Over The Counter Hearing Aid Regulations Jacksonville Speech And Hearing Center

Does Medicare Cover Hearing Aids Lsh

Lively Hearing Aids Reviews With Costs Retirement Living

Why Insure Hearing Aids Against Accidental Loss Or Damage Pristine Hearing Perth Hearing Aid Hearing Test And Tinnitus Specialists Adults Children

How Much Do Hearing Aids Cost Goodrx

Community Hearing Aid Programs Jacksonville Speech And Hearing Center

The 8 Best Invisible Hearing Aids In 2022 Aginginplace Org

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Can Airpods Be Used As Hearing Aids Lsh